Budgets and Tax Rates

Rusk County ESD #1 Budgets

FY 2025-2026 Approved Budget with two year history.pdf2024-2025 ESD Budget.pdf2024 ESD Approved Budget2023 Approved Budget2023 Amended Budget - April.pdfAnnual Budget and Tax Rate Meetings and Information

2025 Tax Rate Hearing - September 11, 2025 NOTICE TO THE PUBLIC2025 Tax Rate calculations worksheetAttestment of 2024 tax rate.pdfRCESD Aug 27 2024 Special Meeting Agenda.pdfProperty Tax Table.pdfNOTICE ABOUT 2025 TAX RATES

Property Tax Rates in Rusk County Emergency Services District No. 1.

This notice concerns the 2025 property tax rates in Rusk County ESD No. 1.

This notice provide information about two tax rates used in adopting the current tax year’s tax rate. The no-new-revenue tax rate would impose the same amount of taxes as last year if you compare properties taxed in both years. In most cases, the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election. In each case, these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. The rates are given per $100 of property value.

This year’s no-new-revenue tax rate: $0.076280/$100

This year’s voter-approval tax rate: $0.084493/$100

To see the full calculations, please visit https://www.ruskcountytxfire.gov for a copy of the Tax Rate Calculation Worksheet.

Unencumbered Fund Balances

The following estimated balances will be left in the taxing unit’s accounts at the end of the fiscal year. These balances are not encumbered by corresponding debt obligation.

Type of Fund

Balance

General Fund

$395,000

Money Market Fund

$1,941,000

Current Year Debt Service

The following amounts are for long-term debts that are secured by property taxes. These amounts will be paid from upcoming property tax revenues.

| Description of debt | Principal of Contract Payment to be Paid from Property Taxes | Interest to be Paid from Property Taxes | Other Amounts to be Paid | Total Payment |

|---|---|---|---|---|

| Building Remodel | $2,570,762.00 | $2,401,720.87 | 0 | $4,972,482.87 |

| Radio Communications System | $937,587.05 | $213,559.12 | 0 | $1,151,146.15 |

Total required for 2025 debt service : $1,000,000.00

- Amount (if any) paid from funds listed in unencumbered funds: $1,000,000.00

- Amount (if any) paid from other resources: $ 0

- Excess collections last year: $0

= Total to be paid from taxes in 2025: $0

+ Amount added in anticipation that the taxing unit will collect only 100% of its taxes in 2025: $0.00

= Total Debt Levy: $0.00

This notice contains a summary of the no-new-revenue and voter-approval calculations as certified by LaKeisha Jiles, Chief Deputy Rusk County Tax Office, August 1, 2025.

Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information about proposed tax rates and scheduled public hearings of each entity that taxes your property.

The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state.

2025 Proposed Tax Rate

At the Regular Called Meeting of the Rusk County Emergency Services District #1 held on August 21, 2025 at 7 PM. at 1515 Whippoorwill Ave. Henderson, Texas 75652 to approve and adopt the proposed 2025 tax rate of $0.076280 per $100 - the No-New-Revenue Rate

Motion for Approval Made By: Gloria Dooley

Motion Duly Seconded By: James Dukes

Board Members Voting For Motion: David Burks, Gloria Dooley, Wayne Griffith, James Dukes

Board Members Voting Against Motion: N/A

Board Members Present & Abstaining: N/A

Board Members Absent: N/A

Attested by: Gloria Dooley, Secretary/Treasurer

Signed by: David Burks, RCESD #1 President

YOUR TAXES OWED UNDER ANY OF THE TAX RATES MENTIONED ABOVE GAN BE CALCULATED AS FOLLOWS:

Property tax amount= (tax rate) x (taxable value of your property) / 100

Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information about proposed tax rates and scheduled public hearings of each entity that taxes your property.

The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes-in the state.

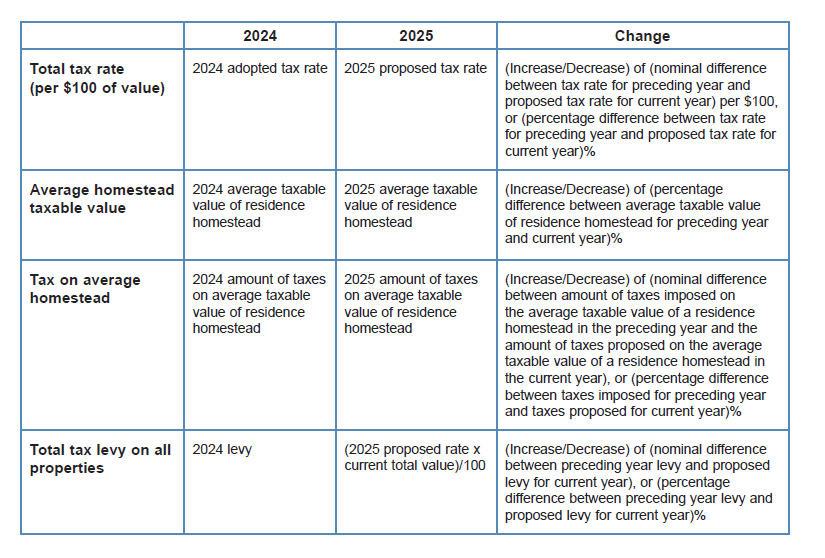

The following table compares the taxes imposed on the average residence homestead by Rusk County Emergency Service District #1 last year to the taxes proposed to the be imposed on the average residence homestead by Rusk County Emergency Service District #1 this year.

(lf the tax assessor for the taxing unit maintains an internet website)

For assistance with tax calculations, please contact the tax assessor for Rusk County Emergency Service District #1 at (903) 657-8571 ext. 106 OR gdooley@ruskcountyfire.org OR visit ruskcountyesd1.com for more information.